Navigating the Probate Process in Oregon

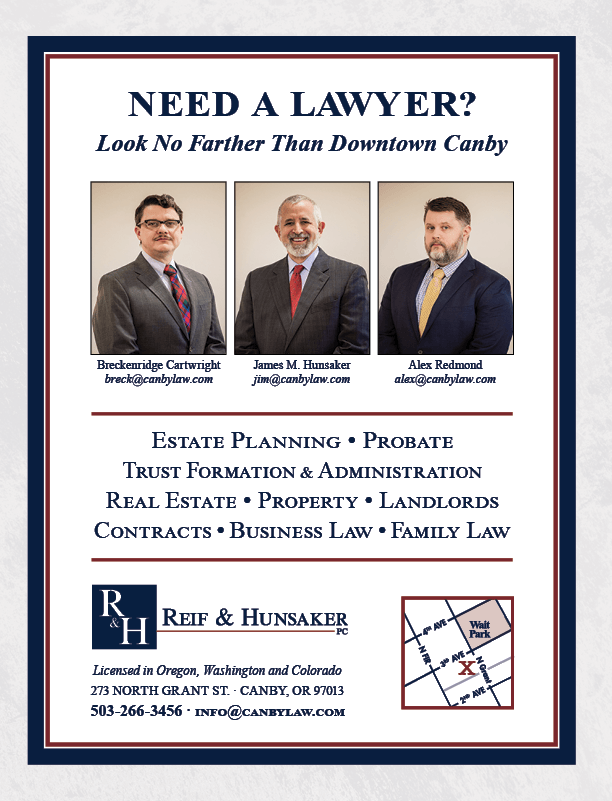

LEGAL LENS

Presented by Reif & Hunsaker

By James M. Hunsaker

Probate can be defined as the court supervised process of transferring the assets of a deceased person to their heirs and devisees. While it can seem complex, it does not need to be an awful or terrible process.

The probate process begins with the filing of a petition in the appropriate county – where the deceased person lived, where their property is located, or where they passed away. This petition typically seeks to appoint a personal representative, sometimes referred to as an executor or administrator, to oversee the administration of the estate. The personal representative is responsible for gathering/inventorying the deceased person’s assets, paying off debts and taxes, filing tax returns, and distributing the remaining assets to the rightful beneficiaries.

One of the first steps is to determine whether the deceased person left a valid will. If a will exists, the original must be submitted to the court along with the petition for probate. The court will then verify the authenticity of the will and ensure that it meets the legal requirements for validity under Oregon law. Under certain circumstances, if the original will is not available, a copy may be probated.

If the deceased person died intestate, meaning without a valid will, the probate process follows the same general process with a few exceptions. In such cases, the court will appoint a personal representative based on state law, which outlines the priority of potential personal representatives, usually starting with the surviving spouse, followed by children, parents, and other relatives.

Once the personal representative is appointed, their duties include identifying and inventorying the deceased person’s assets, such as real estate, bank accounts, investments, and personal belongings. They must also notify creditors of the estate and settle any outstanding debts and taxes owed by the deceased person.

In Oregon, certain assets may be exempt from (or might avoid) the probate process or be subject to simplified procedures. For example, assets held in a living trust or assets with designated beneficiaries, such as life insurance policies or retirement accounts, typically pass outside of probate. Additionally, estates with a total value below a certain threshold may qualify for simplified probate procedures, known as a “small estate” or “simple estate,” which can expedite the administration process.

Throughout the probate process, it is important that the personal representative fulfill their fiduciary duties with diligence and integrity. They must act in the best interests of the estate and its beneficiaries, avoiding conflicts of interest, and make prudent decisions regarding the management and distribution of assets.

Disputes and conflicts can sometimes arise during the probate process, particularly among family members or other interested parties. Common issues may include challenges to the validity of the will, disputes over the interpretation of the will or distribution of assets, and allegations of misconduct by the personal representative. In such cases, it may be necessary to seek resolution through mediation, arbitration, or litigation in court.

We are committed to guiding our clients through this process with care, compassion, and professionalism, helping them achieve a fair and efficient resolution of their loved one’s estate.

The information provided in this article does not, and is not intended to, constitute legal advice; instead, all information and content in this article is for general informational purposes only.