Finding Life-changing Results During A Market Storm That Never Fails

Business Services: Better Planning And Investing

By Founder and Managing Member Christian Kruse, CFP®

There has been much talk of what an inverted yield curve could mean for markets over the next year. An inverted curve generally refers to periods when the two-year US Treasury has a higher yield than a 10-year. These inverted periods are associated with recessions and generally poor market performance. Since June 2022 we have been experiencing just such a period. Despite this, the S&P 500 has held quite well. But given that an inverted yield curve has preceded the last seven recessions, it begs the question:

Are you prepared for a market storm?

How should you prepare?

Do you understand your portfolio risk?

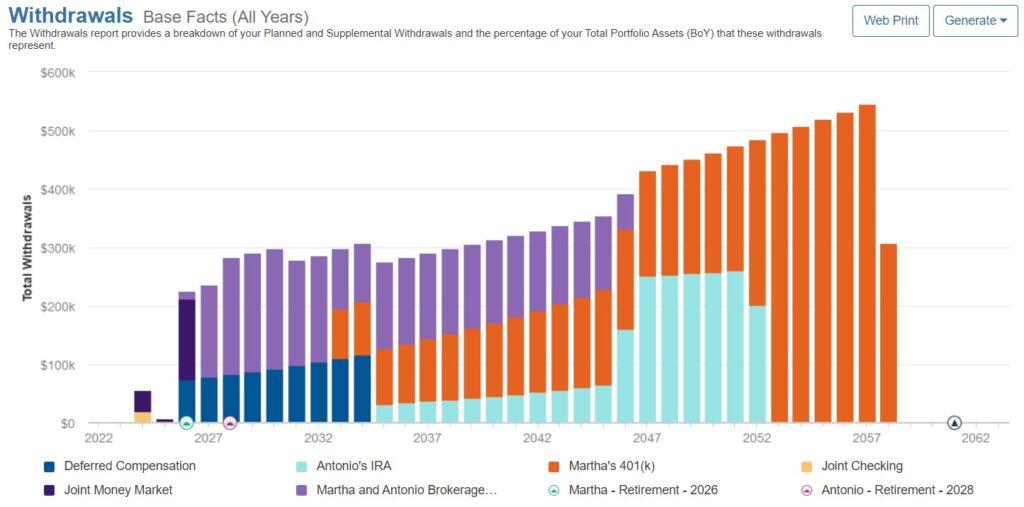

Using historical data, your financial advisor, or Certified Financial Planner®, should be able to illustrate to you the range of returns that can be expected, including worst-case scenarios as seen during the great financial crisis of 2008-2009.

What are your time horizons?

Each investor may have multiple goals that have varying time horizons. If you are retiring in the next three to five years you may feel much more risk averse than someone with a 10+ year horizon. In 2008, many dreams of an early retirement were destroyed as the S&P 500 declined by more than a third in value.

Do you have enough cash to weather a market storm?

Do you maintain enough cash to weather a recession? Data from the National Bureau of Economic Research shows that between 1854 and 2022, the average recession lasted 17 months. If you are currently working, financial planners recommend 3-6 months of expenses. For retirees, 6-12 months is more appropriate. This cash cushion may prevent you from having to sell investments at the worst possible time: when the market is down! If you are working with a Certified Financial Planner®, they should be aware of your current expenses, of what portion is fixed and how much you should have set aside. The good news is, with rising interest rates, money markets are finally paying in the 5% range after over a decade of paying next to nothing.

Preparing for higher volatility or even a recession requires that both you and your advisor are communicating what your income needs are, agreeing on your risk tolerance and having enough cash on hand so that life’s unexpected events don’t force you to sell at the worst time. Working with a Certified Financial Planner® has the benefit of evaluating not just investment returns, but income and spending cash flows for future years while anticipating risks that could affect your goals.

Conversely, being well prepared may mean that when new opportunities present themselves, you are well positioned to take advantage of them for future benefit. At Better Planning & Investing we develop strategies to meet your future retirement needs, then look for opportunities to create wealth that may increase your comfort in retirement, plan for unanticipated needs or pass wealth to a new generation in the most tax efficient way.

Better planning and investing

Financial Advisors do not provide specific tax/legal advice and this information should not be considered as such. You should always consult your tax/legal advisor regarding your own specific tax/legal situation. Separate from the financial plan and our role as a financial planner, we may recommend the purchase of specific investment or insurance products or account. These product recommendations are not part of the financial plan and you are under no obligation to follow them. Life insurance products contain fees, such as mortality and expense charges (which may increase over time), and may contain restrictions, such as surrender periods. Better Planning and Investing LLC is a registered investment advisor in the state of Oregon.

LET’S TALK ABOUT HOW FINANCIAL PLANNING CAN HELP YOU MEET YOUR GOALS

· No sales commissions!

· Independent, fee-based advice.

Give Christian a call today!

(503) 217-2258

WE OFFER A

NO COST

Initial Plan

· A fiduciary who puts your interests ahead of theirs.

· Comprehensive planning, not just investment advice.

Financial planners typically charge $1,500 to $2,500 for an initial plan. This is due to the time required to gather and analyze client data. By creating greater efficiencies and using the best secure technology Better Planning & Investing has greatly lowered the cost. We’re also confident that once you see the value we provide, you’ll want to become a client for an asset-based fee.

Christian Kruse